Kiah Treece is a small business enterprise proprietor and private finance skilled with encounter in loans, business and private finance, insurance policy and real estate.

True amortization, level and extension of credit rating are subject to vital credit approval. Bank of The united states credit history requirements and documentation demands use. Some constraints could utilize.

Have lower borrowing limits. Lenders are generally additional cautious with unsecured vs. secured loans. That’s why you normally can’t get authorized for as huge amounts should you’re applying for an unsecured loan as compared with secured loans.

As soon as you’ve observed a lender supplying a loan you think you may qualify for with affordable conditions, you could post an software. Should your software is approved, you’ll acquire the borrowed money and begin loan repayment.

In case you’re searching for a secured own loan, we’ve rounded up our prime picks that can assist you locate the one that’s best for your needs.

We attempt to offer you information regarding products and services you may locate intriguing and handy. Connection-based ads and on the web behavioral promoting assist us try this.

And because of its minimum cash secured loan amount loan total, this products may be an awesome fit if you have already got a Areas savings account and wish a small loan.

Credit rating Karma strives to offer a wide array of offers for our users, but our delivers usually do not characterize all money services, firms or solutions.

The collateral demands — What residence does one have that the lender will acknowledge as collateral? Some lenders only settle for a paid-off car or truck, while others can be ready to take a financial savings account.

Getting a personal loan lender is like getting a tree inside of a forest: They’re everywhere you go. You commonly can take out a private loan from one among a few differing kinds of lenders.

Secured loans are debts that happen to be backed by a beneficial asset, often called collateral. This asset usually takes the form of the price savings account or property, like vehicles or properties. Collateral could make it much easier for the people with bad credit rating to acquire out debt and entry lower rates.

Particular loans are generally unsecured and do not call for the borrower to pledge any collateral. Nevertheless, unsecured loans is usually tricky to qualify for or might come with prohibitively superior curiosity rates.

Skills Upgrade considers your credit score score, credit utilization, and credit score historical past but doesn’t listing precise prerequisites.

To find out more about ad possibilities, or to decide away from interest-based mostly promoting with non-affiliated 3rd-get together web-sites, stop by YourAdChoices layer run with the DAA or throughout the Network Marketing Initiative's Choose-Out Tool layer. You may also stop by the individual websites for additional info on their facts and privateness tactics and choose-out choices.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Shaun Weiss Then & Now!

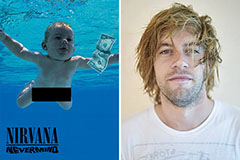

Shaun Weiss Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now!